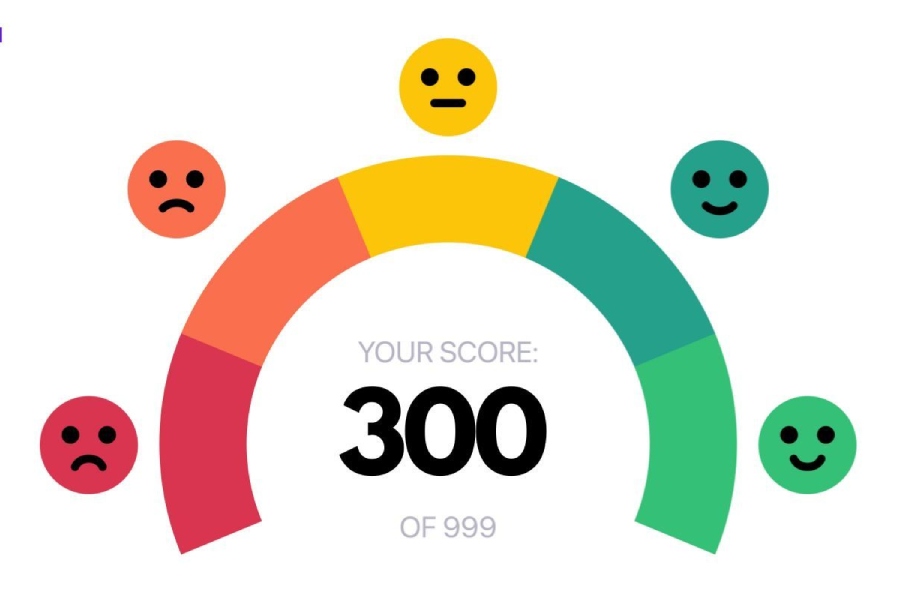

A credit score is an essential factor that lenders use to determine an individual’s eligibility for personal loans. If you’re looking to secure a loan with a credit score of 300, you might face significant challenges, as this is considered a very low score. Typically, a CIBIL score ranges between 300 and 900, and a score of 300 to 600 is usually insufficient to qualify for most types of personal loans. However, there are ways to improve your chances of securing a loan even with a low credit score.

What is a CIBIL Score?

CIBIL, or Credit Information Bureau India Limited, is a credit rating agency authorized by the Reserve Bank of India (RBI). It assesses an individual’s creditworthiness based on their credit exposure, payment history, loan duration, and credit types.

A valid CIBIL score ranges from 300 to 900:

- 750 and above: Excellent score, which facilitates easier loan approvals.

- 500-750: A decent score, but may face higher interest rates or stricter terms.

- Below 500: A poor score, making it difficult to secure a loan.

Lenders are more likely to offer personal loans to individuals with a higher CIBIL score, while those with lower scores may face higher interest rates or loan rejections.

How a Low CIBIL Score Affects Personal Loans

If you have a low credit score, it can impact your chances of securing a personal loan in several ways:

- High-interest rates: Lenders may charge higher interest rates to compensate for the risk of lending.

- Low loan amounts: The amount you qualify for may be significantly reduced.

- Loan rejection: Many lenders may reject your application outright if your score is too low.

Factors Affecting CIBIL Score

Your CIBIL score can be impacted by several factors:

- Repayment History: Missing payments on past loans or credit cards can decrease your score.

- Credit Usage: Using too much of your credit card limit or making frequent purchases can negatively impact your score.

- Number of Loan Applications: Frequent loan applications can hurt your score, as each inquiry lowers it.

- Credit Mix: Having a mix of secured (e.g., home loans) and unsecured loans (e.g., personal loans) is ideal.

- Credit History: A longer, positive credit history tends to improve your score.

How to Improve a Low CIBIL Score

Improving your CIBIL score takes time, but you can take the following steps:

- Repay loans and credit card bills on time.

- Pay off existing debts as soon as possible.

- Limit credit card usage, ideally staying below 30% of your credit limit.

- Maintain a mix of secured and unsecured loans.

- Check your credit report regularly for errors and rectify them.

How to Secure a Loan with a Low CIBIL Score

Securing a loan with a 300 credit score is challenging, but it’s not impossible. You can increase your chances by:

- Providing evidence of income: Demonstrating a stable job and income can help assure lenders of your ability to repay.

- Applying for a smaller loan amount: Lenders may be more willing to approve a smaller loan with a lower risk.

- Getting a co-applicant: A co-applicant with a higher credit score can improve your loan approval chances.

- Rectifying errors in your credit report: Ensure your credit report is accurate and up-to-date before applying for a loan.

Benefits of Low Credit Score Loans

Despite the challenges, there are benefits to availing a loan with a low CIBIL score:

- Competitive interest rates are still possible in some cases.

- Loan amounts for education or personal needs may still be available with lower interest rates and flexible terms.

- Flexible tenures and convenient EMI options can help you manage repayments effectively.

Documents Required for Low Credit Score Loan Applications

You will need several documents to apply for a low-credit score loan, including:

- Identity Proof: Aadhar card, passport, or driver’s license.

- Address Proof: Aadhar card, utility bills, or rental agreement.

- Bank Statements: Last 6 months’ statements to demonstrate financial stability.

- Income Proof: Pay slips for the past 6 months, income tax returns (ITR), etc.

- Additional Documents for Self-Employed: Company registration, balance sheet, profit and loss statement, ITR for the past 3 years.

Conclusion

While securing a loan with a 300 credit score is not easy, it is not entirely out of reach. By providing proof of steady income, applying for a lower loan amount, and working with a co-applicant, you can increase your chances. Additionally, keeping your credit report accurate and ensuring timely payments will help you improve your score over time. Always approach trusted lenders and ensure that you are able to repay the loan comfortably to avoid further financial stress.